Unit of production depreciation calculator

Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along. Total Variable Cost 20000 So total variable cost of 1000 boxes is 20000.

Calculating Depreciation Unit Of Production Method

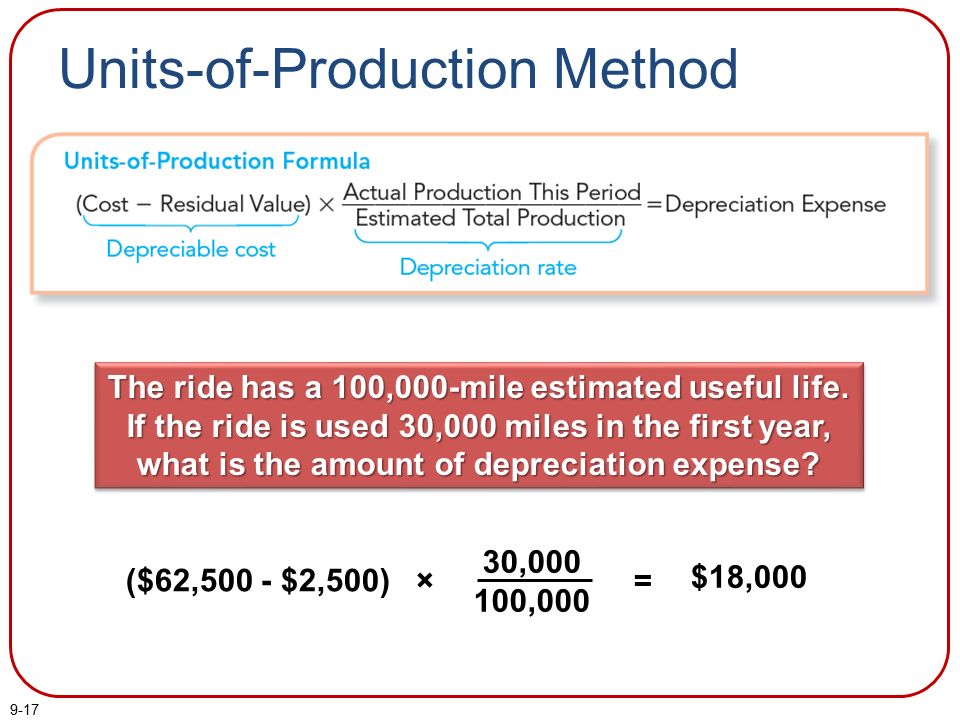

Put the values in the above formula.

. Activity such as miles for a car cycles for a machine or time usage. Get all the latest India news ipo bse business news commodity only on Moneycontrol. The calculator also offers a visualization of the EOQ model in graphic form.

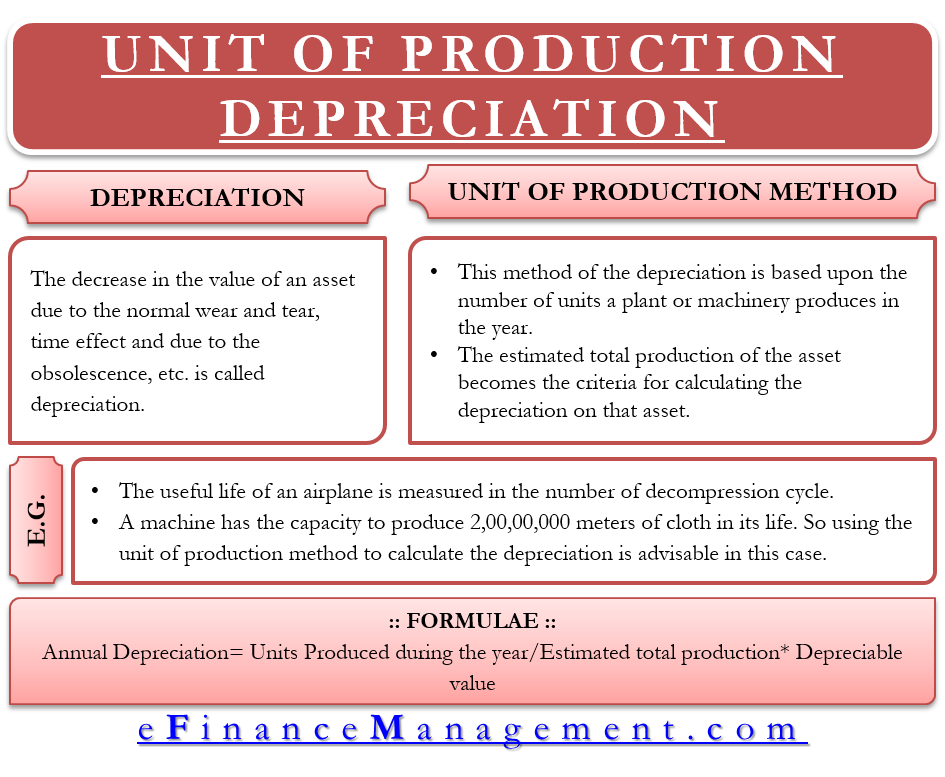

Depreciation under Income Tax Act is the decline in the real value of a tangible asset because of consumption wear and tear or obsolescence. You can use the following Calculator. Total Depreciation Per Unit Depreciation Total number of Units Produced.

The average cost basisbase value is purchase price minus accumulated depreciation for purchased breeding stock. Depreciation per Unit Time Depreciable Base Useful Time Units. Get 247 customer support help when you place a homework help service order with us.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Life-time production capacity indicates the total no. Methods of depreciation as per Income Tax Act 1961 Based on Specified Rates.

Download mod Parts It is not difficult to find a suitable vector template as our company is engaged in the graphics production for ATV Side by Side Motocross Trial Bike Snowmobile and Jet ski Detailed high resolution artwork manufactured with aggressive adhesive and a thick UV protected scratch resistant over-laminate that holds up. The cost is listed in cell C2 50000. This lets us find the most appropriate writer for any type of assignment.

Calculate the depreciation per activity and for any period. This simple Economic Order Quantity EOQ calculator can be used for computing the economic optimal quantity of goods or services a firm needs to order. Depreciation per unit produced and depreciation for a period.

The only complain i have that I was told this led light would last for a long time but its died twice and the Whirlpool refrigerator is only two years old IcetechCo W10515057 3021141 LED Light compatible for Whirlpool Refrigerators WPW10515057 AP6022533 PS11755866 1 YEAR WARRANTY This is shown on the service. This calculator is for units of production method of depreciation of an asset or the amount of depreciation for each unit and period. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022.

We need to define the cost salvage and life arguments for the SLN function. Updated Study Notes and Revision Kits MASOMO MSINGI PUBLISHERS. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

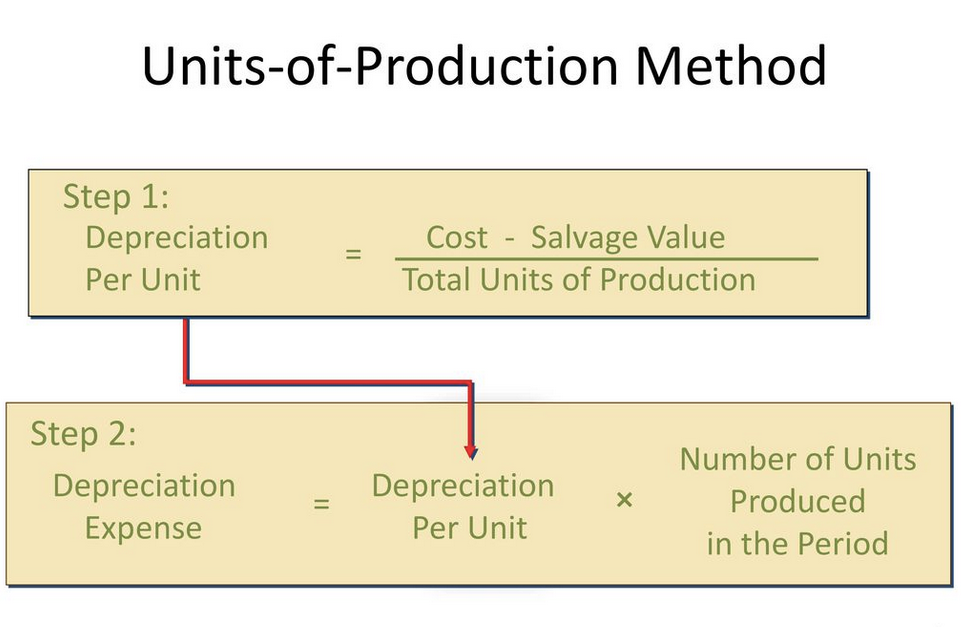

Fixed Cost Explanation. The following additional steps can be used to derive the formula for depreciation under the unit of production method. This calculation is equivalent to our units of activity depreciation calculator.

Activity such as units produced. A photovoltaic power station also known as a solar park solar farm or solar power plant is a large-scale grid-connected photovoltaic power system PV system designed for the supply of merchant powerThey are differentiated from most building-mounted and other decentralised solar power because they supply power at the utility level rather than to a local user or users. 2 Average cost basis is important because it impacts the net income calculation and profitability figures.

Unit of Production Method. Section 179 deduction dollar limits. So determine the life-time production capacity of the asset in terms of units.

And life for this formula is the life in periods of time and is listed in cell C4 in years 5. Currencies are most commonly national currencies but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro. Depreciation Asset Cost Residual Value Useful Life of the Asset.

Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property. Calculate Property Depreciation With Property Depreciation Calculator. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

Book value is found by deducting the accumulated depreciation from the cost of the asset. For raised breeding stock it is the base value of the animal the cost of raising the animal to that stage eg. We have to find the straight line depreciation method using the first method.

Total Variable Cost 1000 20. The exchange rate is also regarded as the value of one countrys currency in relation to another currency. This lets us find the most appropriate writer for any type of assignment.

If you didnt deduct enough or deducted too much in any year see Depreciation under Decreases to Basis in Pub. Salvage is listed in cell C3 10000. This calculator performs calculation of depreciation according to the IRS Internal Revenue Service that related to 4562 lines 19 and 20.

Calculate the depreciation per unit produced and for any period based on activity for that period. Now let us calculate the average total cost when. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Activity Method Depreciation Calculator. Mathematically we can apply values in the below. Depreciable Base Asset Cost - Salvage Value.

Depreciation per unit time and depreciation for a period based on total time the asset was used in that period. As the name suggests these costs are variable in nature and changes with the increase or. The formula for fixed cost can be calculated by using the following steps.

Firstly determine the variable cost of production per unit which can be the aggregate of various cost of production such as labor cost raw material cost commissions etc. The production method calculation results from 3 equations. In finance an exchange rate is the rate at which one currency will be exchanged for another currency.

Use our Tax Calculator software claim HRA check refund status and generate rent. Depreciation you deducted or could have deducted on your tax returns under the method of depreciation you chose. Another example where the total fixed cost of production of a company stood at 1500 while the variable cost of production per unit varies with production quantity.

Whirlpool Refrigerator Led Lights Flashing. Similar to the activity depreciation the time depreciation calculation results from 2 equations. A few examples of the fixed cost of production are depreciation cost.

Hindustan Electro Graphites HEG on Wednesday said it will become the worlds largest company in graphite production after an investment of Rs 1200 crore in its existing facility at Mandideep near Bhopal. To utilize this calculator simply fill in all the fields below and then click the Calculate EOQ button. HEG chairman and managing director Ravi Jhunjhunwala apprised Madhya Pradesh chief minister Shivraj Singh Chouhan that a capital investment of Rs 2000.

Double Declining Balance Method. Total expense done in business is the sum of variable cost and fixed cost where fixed cost is fixed irrespective of quantity manufacture or produced whereas variable cost depends on quantity produced. Special depreciation allowance or a section 179 deduction claimed on qualified property.

Units of Production Depreciation Calculator.

Depreciation Formula Examples With Excel Template

How Do I Calculate Depreciation Formula Guides Examaples

Depreciation Formula Calculate Depreciation Expense

Long Lived Tangible And Intangible Assets Ppt Download

Depreciation Formula Calculate Depreciation Expense

Annual Depreciation Of A New Car Find The Future Value Youtube

The Units Of Production Method Of Depreciation Part 1 Of 2 Youtube

How To Calculate Units Of Production Depreciation In Excel

Depreciation All Concepts Explained Oyetechy

Unit Of Production Depreciation Method Formula Examples

Units Of Production Depreciation Calculator Double Entry Bookkeeping

Units Of Production Depreciation Method Double Entry Bookkeeping

Units Of Production Depreciation Calculator Efinancemanagement

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Unit Of Production Depreciation Efinancemanagement

Depreciation Formula Examples With Excel Template